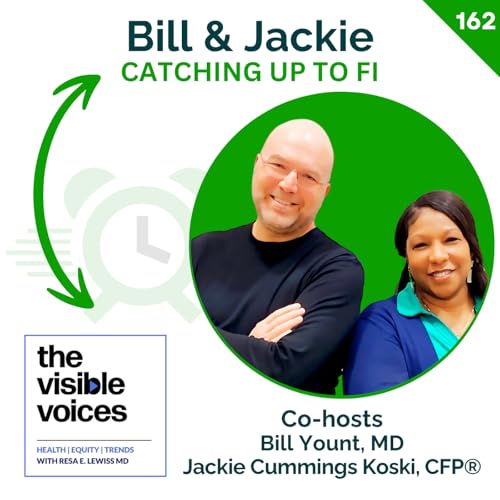

Ruth Henderson is the creator of ‘The Happy Saver,’ a beloved New Zealand blog and podcast that brings personal finance down to earth. She transitioned from part-time work to full-time content creation, sharing her journey toward early retirement with honesty, humor, and heart. In this episode we swap notes with her on the financial independence journey of Americans vs. Kiwis (New Zealanders). She also shares with us:

- Her late starter journey to FI

- What inspired her to create 'The Happy Saver' to help everyday Kiwis reach FI

- A breakdown of New Zealand's surprisingly simple ecosystem including universal healthcare and pension

- How KiwiSaver operates similarly to US employer-sponsored retirement plans

📩 Sign up for our newsletter (NEW!)

🌐 Visit Catching Up to FI website

🔗Connect with us

☕ Like what you hear on Catching Up to FI? Support the show at "Buy Me a Coffee"

🎙️We love hearing from you! Record a Voice Message with your feedback or question Record a Voice Message with your feedback or question

===DEALS & DISCOUNTS FROM OUR TRUSTED PARTNERS===

🆕Big changes with student loans in the new budget bill that just passed. Get help from the experts at Student Loan Planner, all CFP®, CFA and CSLP® professionals. They charge a one-time fee for their thorough review. Our listeners receive $100 off a 1:1 consult using the link below. Flat fee is normally $595, but after your $100 off ‘Catching Up to FI’ discount, it's $495.

👉🏼 Be sure to use this link: studentloanplanner.com/catchingup

For a full list of current deals and discounts from our partners, sponsors and affiliates, click here: catchinguptofi.com/our-partners

RESOURCES MENTIONED ON THE SHOW: (As an Amazon Associate, I earn from qualifying purchases.)

🌐The Happy Saver

The Happy Saver Podcast

Rebel Finance School

Sorted

Sorted Smart Investor

If you enjoyed this episode, please follow the show on your podcast player and leave us a rating or review. If you want to watch, be sure to subscribe to our YouTube Channel. This helps others find the show and keeps us creating great content for you!

⚠️Disclaimer: Our content is for general education and information purposes only. We are not providing financial, legal, or tax advice. Always do your own research or consult a professional before making important decisions.

1 hr and 1 min

1 hr and 1 min 50 mins

50 mins 1 hr and 7 mins

1 hr and 7 mins 1 hr and 23 mins

1 hr and 23 mins 1 hr and 10 mins

1 hr and 10 mins 37 mins

37 mins 1 hr and 30 mins

1 hr and 30 mins Aug 3 20251 hr and 24 mins

Aug 3 20251 hr and 24 mins